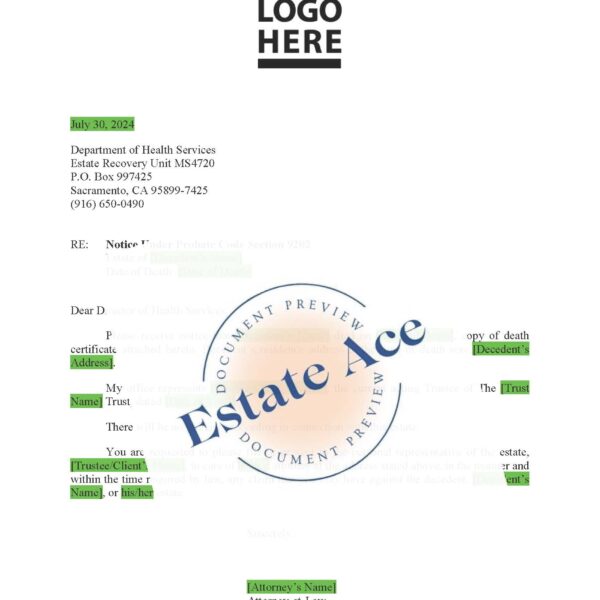

California Franchise Tax Board Notification of Decedent’s Death

$10.00

Ensure Compliance with Probate Code § 9202(c)(1)

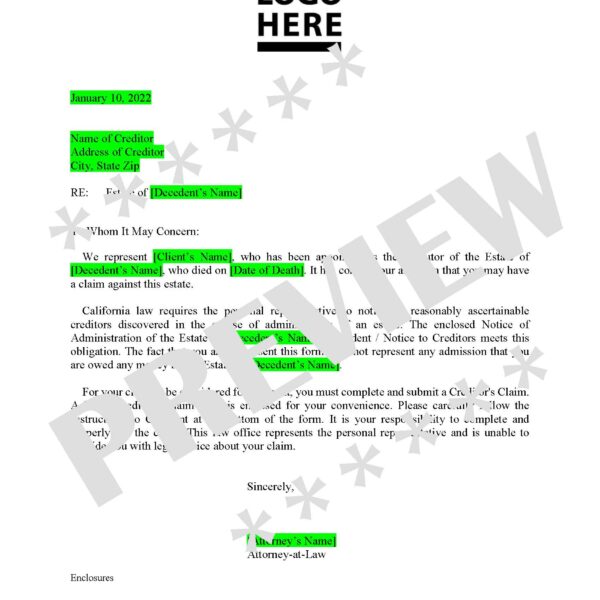

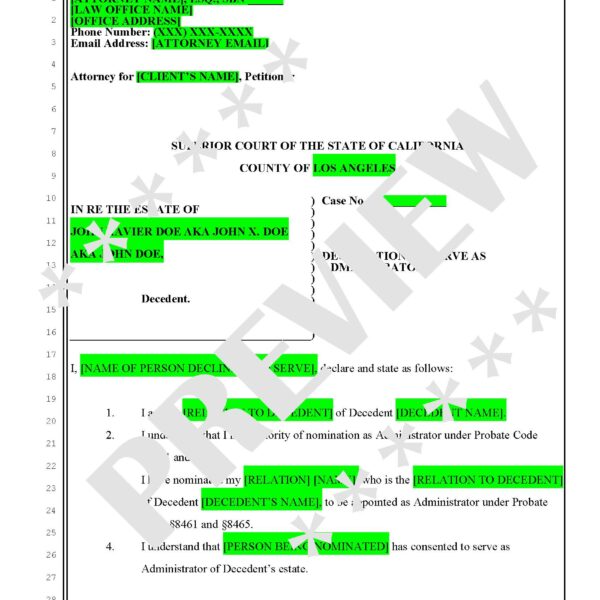

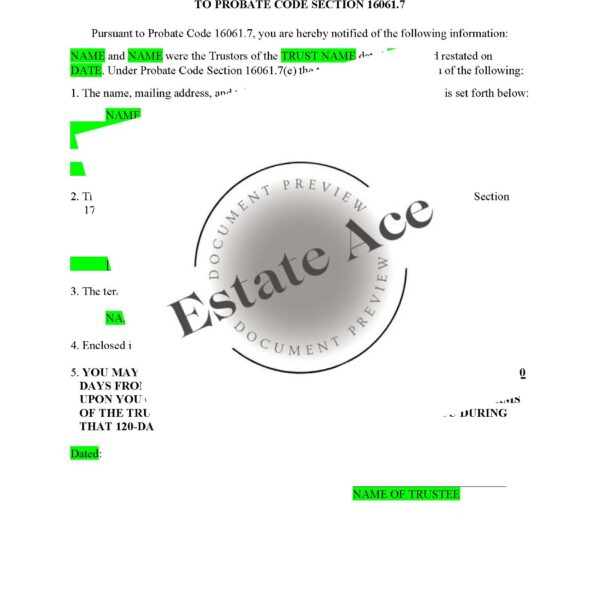

This Franchise Tax Board Notification Letter is a professionally drafted template for notifying the California Franchise Tax Board (FTB) of a decedent’s passing. This notice ensures compliance with California Probate Code § 9202(c)(1) and provides a formal request for any outstanding claims against the decedent’s estate.

What’s Included:

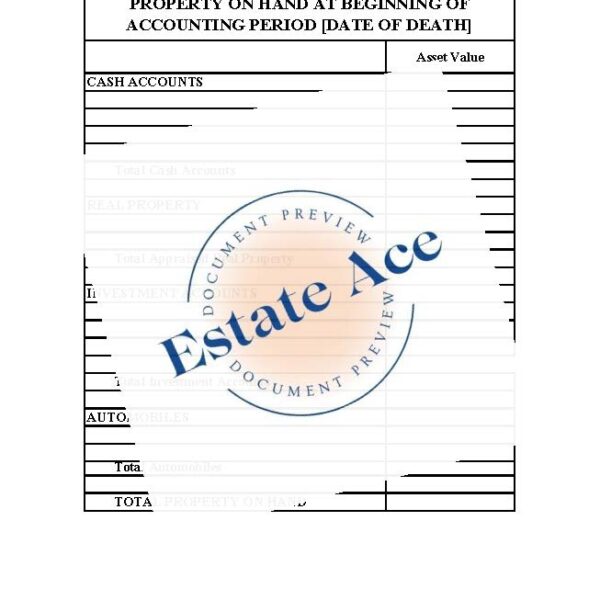

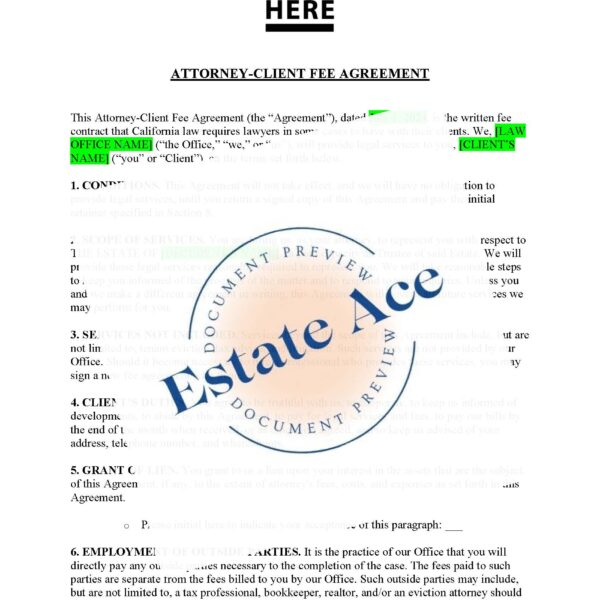

✔ Legally Compliant Notification – Properly formatted notice in accordance with California law.

✔ Essential Decedent Information – Includes the decedent’s full name, date of death, and last known address.

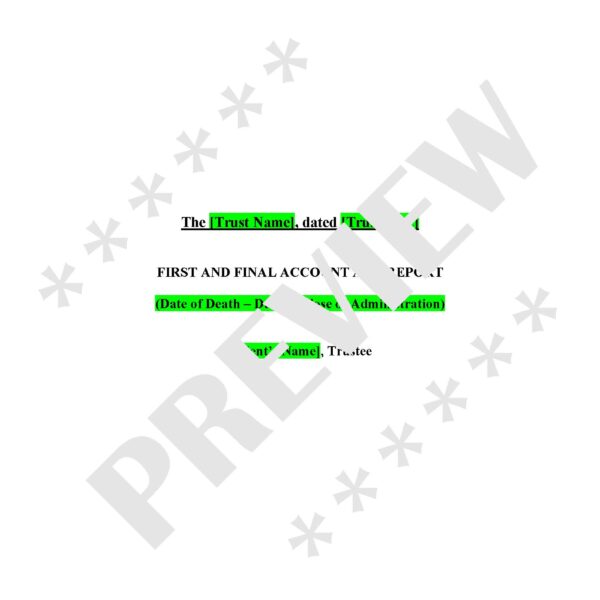

✔ Trust & Estate Representative Details – Identifies the trustee or personal representative handling the estate.

✔ Claim Request Statement – Requests the FTB to file any claims against the estate within the legally required timeframe.

✔ Attachment Instructions – Space to include a certified death certificate for proper verification.

✔ Customizable Format – Available in Word and PDF for easy editing and firm branding.

Why This Letter is Essential:

✅ Meet Probate Code Requirements – Ensures the estate follows legal obligations for tax and debt notifications.

✅ Protect the Estate & Trustee – Proper notification reduces liability and helps prevent future tax disputes.

✅ Facilitate a Smooth Administration – Helps trustees and personal representatives handle tax-related matters efficiently.

✅ Attorney-Approved Format – Professionally drafted for seamless court and government agency submissions.

📥 Instant Download – Fully Editable & Ready to Use

Stay compliant with California law—Download your FTB Notification Letter today!

Vendor Information

- Store Name: Estate Ace

- Vendor: Estate Ace

- No ratings found yet!

Reviews

Clear filtersThere are no reviews yet.